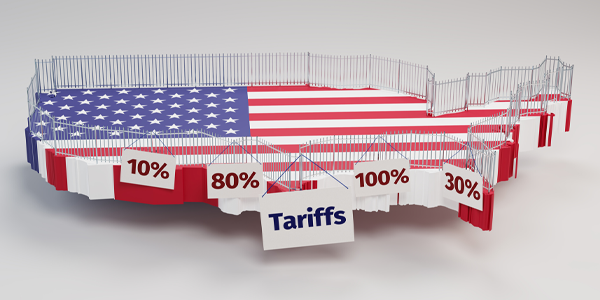

Trade policy has long played a central role in shaping global economic dynamics. In recent years, however, the resurgence of protectionist measures, particularly those implemented by the United States, has reignited debates about their broader economic consequences. Among these, tariffs—import taxes imposed on foreign goods—have had a marked impact not just on international trade flows, but also on domestic inflation and food prices.

For millions of Americans, the consequences of these policies are felt directly through their household finances, as price volatility in essential goods such as groceries affects everyday life. As trade tensions persist or escalate, understanding how these economic instruments ripple through supply chains to reach consumers becomes critical.

Understanding the mechanics of tariffs and their economic rationale

Tariffs function as a tool of economic policy designed to influence trade balances by making imported goods more expensive relative to domestic products. When a country imposes tariffs, it aims to protect local industries from foreign competition by discouraging the purchase of cheaper international alternatives. In theory, this should encourage domestic production and employment while correcting trade deficits.

In the United States, tariffs have been prominently used as part of the broader “America First” trade strategy. Although the intention was to revitalize American manufacturing and counteract what were perceived as unfair trade practices, these measures also triggered retaliation from trade partners, resulting in a tit-for-tat escalation that hurt both sides of the trade relationship.

One of the most critical oversights in the rationale for imposing tariffs is the underestimation of global supply chain interdependence. In an increasingly integrated world, most goods are not produced within one country but involve components from multiple nations. Tariffs can disrupt this chain at several points, leading to higher costs for raw materials, intermediate goods, and ultimately, final consumer products.

The transmission of tariff effects to domestic inflation

Tariffs directly raise the price of imported goods, but their influence on inflation goes well beyond that immediate impact. When tariffs are placed on intermediate goods such as machinery, fertilizers, or packaging materials, the cost of producing a wide range of domestic products increases. Producers facing higher input costs often pass these expenses onto consumers in the form of higher prices, thereby contributing to inflation.

This cost-push inflation mechanism is particularly relevant when tariffs affect sectors like agriculture, manufacturing, and energy. For instance, when the US imposed tariffs on Chinese imports, the cost of industrial components and technological goods surged, affecting everything from electronics to farming equipment. These increases ripple through the economy, influencing production costs in sectors that rely on those inputs.

Inflation stemming from trade policy is further exacerbated by retaliatory tariffs from other nations. When countries like China and the European Union respond with their own tariffs, US exporters face reduced demand abroad. This puts downward pressure on American farmers and manufacturers, many of whom must lower prices to remain competitive internationally while simultaneously contending with higher input costs.

How food prices respond to trade barriers and market uncertainty

Food prices are among the most sensitive indicators of economic volatility. Because food is a necessity, even minor changes in its cost have significant consequences for household budgets and overall inflation rates. The imposition of tariffs, particularly those affecting agricultural inputs, transportation, and labor, can lead to considerable spikes in food prices. These effects are not only immediate but often sustained over time, as supply chains struggle to adapt to the new economic environment.

For example, tariffs on aluminum and steel—which are essential for producing food packaging—lead to increased costs for canned goods and beverages. Similarly, tariffs on fertilizers and pesticides can raise production costs for farmers, which are then passed on through higher wholesale and retail prices. Moreover, when tariffs disrupt the import of key food items or ingredients, domestic suppliers may be unable to meet demand, causing scarcity and price inflation.

Another layer of complexity arises from the geopolitical nature of trade policy. Agricultural exports such as soybeans, corn, and pork became focal points during the US-China trade war. As China imposed retaliatory tariffs on American agricultural products, US farmers were left with unsold stockpiles and diminished revenue.

The federal government introduced subsidy programs to alleviate these losses, but they were insufficient to offset the long-term economic damage. Meanwhile, consumers faced higher prices for goods previously imported from abroad, and domestic alternatives were either unavailable or more expensive. Companies like Cargill saw operational challenges as a result of the disrupted trade environment, reflecting broader market instability.

The broader implications for food security and inequality

Beyond inflation, trade tariffs have critical implications for food security and social equity. When the cost of essential goods such as food rises due to protectionist measures, the burden falls disproportionately on low- and middle-income households. These groups often lack the financial flexibility to absorb increased living costs and are forced to make difficult choices between food, housing, healthcare, and other necessities.

Food insecurity, which was already a pressing issue in the US prior to the recent wave of tariffs, has been exacerbated by rising prices. While wealthier consumers may shift their purchasing habits or absorb price increases with minimal lifestyle changes, vulnerable populations are more likely to face nutritional deficiencies and long-term health problems as a result. Moreover, these economic pressures are not evenly distributed geographically.

In addition to economic inequality, tariffs can also contribute to political and social instability. When large segments of the population perceive that government policies are causing them undue hardship, public trust erodes. This erosion can manifest in reduced consumer confidence, lower voter turnout, and heightened political polarization. Policymakers must therefore weigh the societal impacts of tariffs—not just in economic terms, but also in how they influence the social fabric of the nation.

Policy alternatives and the path forward

To mitigate the inflationary and inequitable consequences of trade tariffs, alternative policy approaches must be considered. Rather than relying on blunt instruments like tariffs, governments can invest in strengthening domestic supply chains, improving agricultural efficiency, and fostering innovation in food production. These measures enhance resilience without distorting global trade or burdening consumers with higher costs.

Negotiated trade agreements, rather than unilateral tariffs, offer a more sustainable path toward achieving economic goals. By engaging in multilateral dialogue and promoting fair trade standards, the United States can address issues like intellectual property theft, labor rights, and environmental protection without sparking retaliatory conflicts.

Lastly, transparency and public engagement are crucial to building effective and equitable trade policy. Citizens should be informed about the potential downstream effects of tariffs and have opportunities to voice their concerns. By grounding economic decision-making in empirical evidence and inclusive dialogue, policymakers can design strategies that promote both national interests and global stability.