Over the past few years, the UK government has rolled out a series of tax reforms aimed at reshaping the incentives behind two of the most popular long-term savings vehicles: Individual Savings Accounts (ISAs) and pensions. These changes are part of a broader effort to modernize the nation’s approach to financial planning while also addressing concerns about fairness, fiscal sustainability, and future readiness. But while some updates may seem like upgrades on paper, they’re stirring up just as much uncertainty as excitement among savers and financial advisors alike.

For generations, ISAs and pensions have provided reliable frameworks for people to build wealth over time. ISAs offered simplicity, flexibility, and tax-free returns, while pensions delivered upfront tax relief and long-term growth potential. Now, however, with evolving economic realities and shifting government priorities, the tax benefits underpinning both structures are being recalibrated. The big question isn’t just what’s changing—it’s how these reforms will shape your future financial strategy. Should you double down on one, rebalance between both, or rethink everything altogether?

Flexibility or fragility? What’s new with ISAs

Let’s start with ISAs, the tax-free accounts many Brits use to save for everything from home deposits to emergency funds. Traditionally, once you used up your annual ISA allowance—currently £20,000—you couldn’t touch or replace withdrawn funds without losing that portion of the limit. But one of the most noticeable changes is the enhanced flexibility that now allows savers to withdraw and redeposit money in the same tax year without affecting their allowance. Dubbed the “Flexible ISA,” this tweak is meant to accommodate the ebb and flow of modern financial life.

On the surface, this seems like a massive win. Got hit with a surprise car repair or medical bill? No problem—you can dip into your ISA and replace the money when things stabilize. But while the added access makes ISAs feel more user-friendly, it also carries the hidden cost of undermining long-term discipline. Savers who frequently dip into their ISAs might never build the momentum needed to achieve real financial growth. And this model demands a new level of personal responsibility and awareness of tax-year timelines that many may not have.

Another notable development is the broader eligibility for Lifetime ISAs, aimed at first-time homebuyers and retirement savers under 40. While the government bonus of 25% on contributions remains attractive, the rules surrounding withdrawals and penalties remain stringent. More flexible rules are being discussed, but for now, it’s still a product best suited to those with clearly defined goals. In short, ISAs are becoming more versatile—but with that versatility comes a new layer of complexity that every saver must learn to navigate.

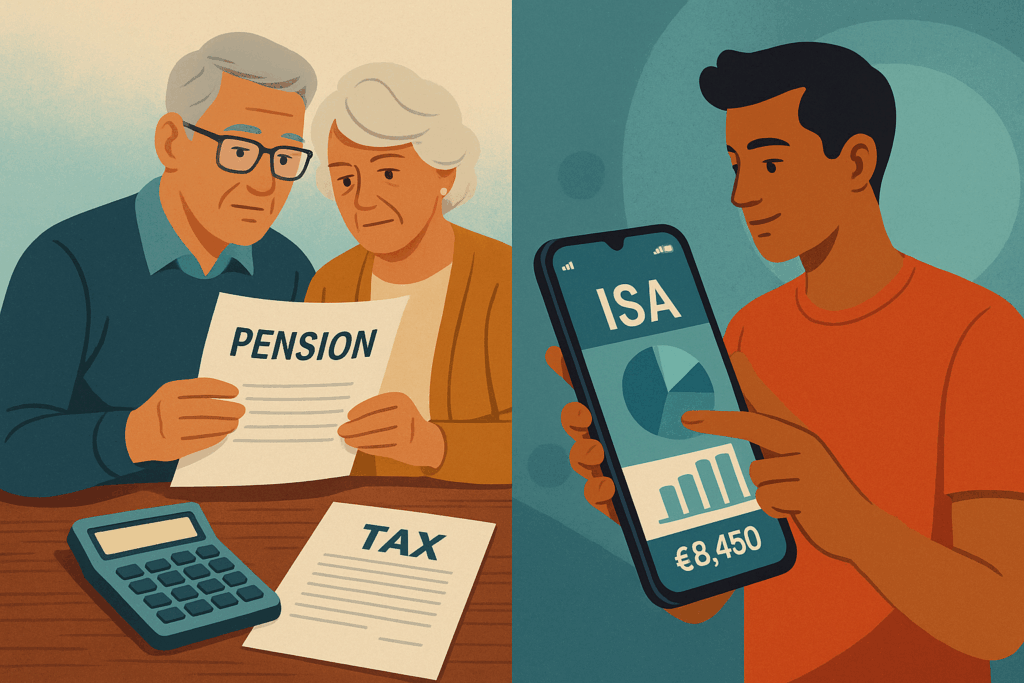

The pension pivot: rising restrictions and shifting relief

If ISAs are evolving toward flexibility, pensions are shifting in the opposite direction—toward tighter restrictions and policy-driven recalibrations. The most headline-grabbing change involves tax relief, long considered the golden carrot for pension contributions. Higher-rate taxpayers have historically enjoyed generous incentives, but the government is now actively reviewing whether to introduce a flat-rate relief—likely in the 25%–30% range—for everyone, regardless of income bracket. This move, positioned as a way to level the playing field, could discourage high earners from contributing large sums to their pensions.

But this is only the beginning. Lifetime and annual allowance thresholds have also come under review. The annual allowance, once comfortably high for most earners, is being squeezed in subtle ways—particularly through the tapered allowance, which affects those with adjusted incomes over £260,000. Meanwhile, the Lifetime Allowance was scrapped in 2023, which at first looked like a win, but is now being reconsidered under new political leadership. As a result, the pension landscape has become more volatile, subject to frequent policy swings that make long-term planning increasingly difficult.

On top of this, pension savers must now contend with stricter access rules and potential taxation on lump-sum withdrawals. Whereas once you could take 25% of your pension tax-free, proposals suggest that portion could be capped or gradually phased out. These developments make it more important than ever to seek financial advice early and often. It’s no longer just about saving—it’s about timing, strategy, and making the most of allowances while they still exist. For many, this might mean front-loading contributions now or exploring employer-matching opportunities more aggressively.

Rebuilding your savings strategy in a post-reform world

So where does that leave the average saver? With change comes uncertainty, but also opportunity. The shifting landscape requires a more tailored and proactive approach to saving. Gone are the days of setting and forgetting your contributions. Today’s savers need to ask hard questions: What are my goals? How soon will I need this money? What’s my appetite for risk? And, most critically, which savings vehicle best aligns with my stage of life? For younger professionals and gig economy workers, the newly flexible ISA rules offer much-needed breathing room.

Having access to funds without sacrificing long-term benefits allows them to respond to short-term life demands without derailing their futures. But even here, a hybrid strategy is key. Pairing ISA savings with smaller, consistent pension contributions—especially when employer matching is available—can build resilience across multiple timeframes. For mid-career individuals, particularly those earning near or above the higher tax brackets, pension contributions remain a tax-efficient vehicle—at least for now.

But it’s crucial to monitor changes closely. Those nearing retirement should begin optimizing their withdrawal strategies, understanding how tax rules could affect their take-home income, and exploring options such as phased drawdown or annuities. Diversification is another vital element. With each savings product subject to its own risks and tax quirks, spreading your investments across multiple accounts can reduce vulnerability to policy shifts.

A diversified mix might include ISAs, pensions, general investment accounts, and even property or business equity for those with entrepreneurial ambitions. Ultimately, the most valuable asset in this new financial era is knowledge. Staying informed, revisiting your plans regularly, and being willing to adjust course will help you thrive in a system that is no longer static. The tax advantages of ISAs and pensions may have changed—but with intentional planning, your long-term security doesn’t have to.